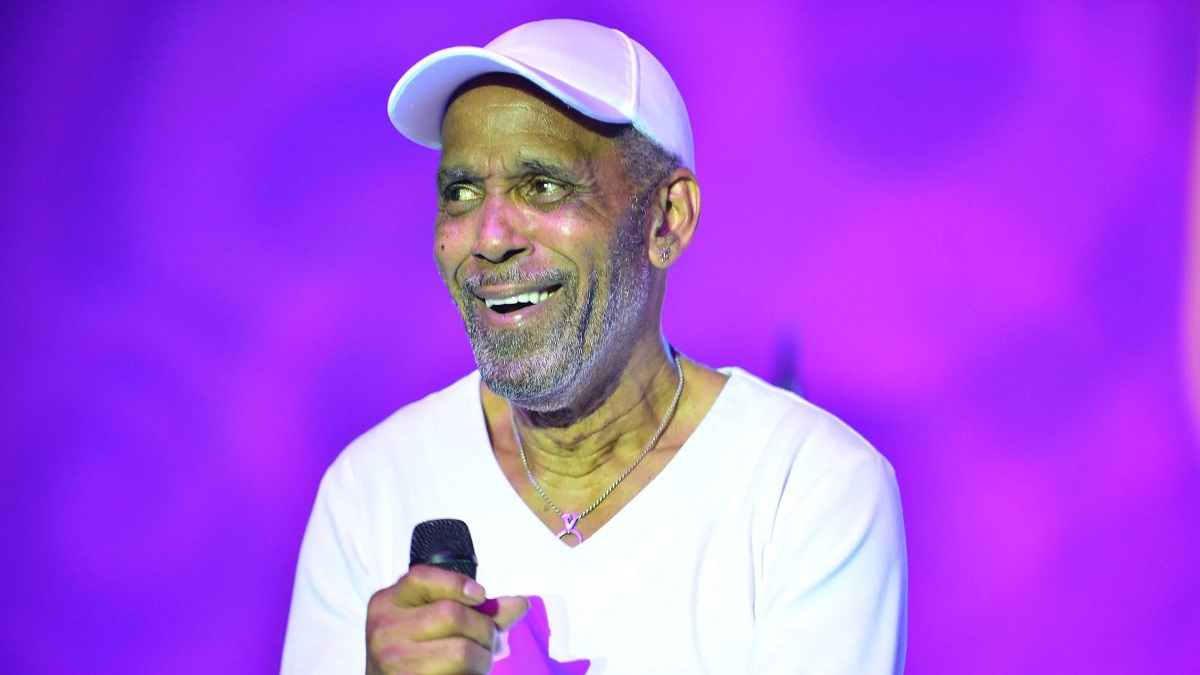

Frankie Beverly Net Worth 2023: Deep Dive

Determining an individual's financial standing, often expressed as their net worth, involves assessing their assets minus their liabilities. This figure reflects the overall financial position of Frankie Beverly. Assets can include investments, real estate, and personal possessions. Liabilities encompass debts, loans, and other financial obligations. Understanding this calculation provides a snapshot of Beverly's current financial situation, a factor relevant to various contexts, such as potential investments or financial comparisons.

Publicly available data regarding Beverly's financial situation is often limited. This is a common characteristic for many public figures, where privacy concerns frequently overshadow details of personal finances. However, the concept of net worth remains an important metric within financial analysis, and in the context of celebrity figures like Beverly, it might be of interest to fans and the media. This kind of financial overview provides context to their career and public persona, allowing for a broader understanding of their life beyond the artistic or professional sphere. Furthermore, it provides potential avenues of discussion in areas such as income sources, business ventures, or even charitable activities.

Further exploration of Frankie Beverly's career trajectory, musical accomplishments, and other significant life events would be necessary for a comprehensive analysis. Such considerations, coupled with careful interpretation of any available financial information, would furnish a well-rounded perspective. This can be a part of a wider study on musicians' economic realities within the music industry or a specific period in time.

- Dina Belenkayas Boyfriend Who Is He And What You Need To Know

- Daniswingsxo Latest Videos Whats Hot And Trending

Frankie Beverly Net Worth

Understanding Frankie Beverly's financial standing requires examination of various factors influencing wealth accumulation. This exploration highlights key aspects contributing to this figure.

- Income Sources

- Career Earnings

- Investment Portfolio

- Real Estate Holdings

- Personal Assets

- Debts and Liabilities

- Financial Management

- Public Perception

Frankie Beverly's income sources, including music royalties and potential business ventures, are crucial in determining their overall wealth. Career earnings accumulate over time, reflecting the success and longevity of a performer's career. Investment strategies and portfolio diversification influence the growth of assets. Real estate holdings provide a tangible component of net worth. Personal assets like vehicles and collectibles also contribute to the calculation. Understanding liabilities, such as loans or outstanding debts, is equally important in calculating net worth. Effective financial management significantly impacts the accumulation and maintenance of wealth. The public's perception of Beverly can influence how their wealth is viewed and discussed, despite its limited accessibility. A holistic picture requires examining all these factors to gain a nuanced understanding.

1. Income Sources

Income sources are fundamental to understanding an individual's net worth. For Frankie Beverly, as with any public figure, income streams directly impact the overall financial picture. Analyzing these streams provides insights into the potential components contributing to accumulated wealth.

- Odia Instagram Viral Mms Latest Trends Videos Your Ultimate Guide To The Hottest Content

- Skymovieshd In India Latest Movies Online Your Ultimate Movie Streaming Guide

- Music Royalties and Performance Fees:

Earnings from music recordings, performances, and associated ventures constitute a significant portion of income for musicians. Royalties from album sales, streaming platforms, and licensed material directly contribute to accumulated wealth. Performance fees from concerts, tours, and other engagements are also substantial income streams, dependent on factors such as venue, ticket prices, and engagement length. Variations in these sources demonstrate the dynamic nature of musician income, directly affecting net worth.

- Endorsements and Partnerships:

Endorsements and partnerships with brands or companies can generate supplemental income. Successful musicians may earn from collaborations, product endorsements, or promotional activities. The extent of these earnings depends on the nature of the partnerships and the artist's market value. Such income streams can significantly impact the individual's net worth.

- Investment Income:

Investment of funds from previous income streams can generate returns over time, further increasing wealth. The type of investment, investment strategy, and market conditions influence the generated income. Investment income represents a compounding effect on net worth, potentially growing significantly over a long timeframe.

- Business Ventures (if any):

If Frankie Beverly has pursued ventures outside music, such as owning businesses or investments, those activities would contribute to income and, subsequently, their net worth. Business ownership can entail various income streams, such as sales, profits, and dividends, each impacting the overall financial position.

Ultimately, the multitude of income streams, from music-related sources to endorsements and investments, directly influences Frankie Beverly's net worth. Evaluating the significance and stability of each stream is essential to understanding the overall financial picture, recognizing that fluctuations in one area can impact the total net worth significantly.

2. Career Earnings

Career earnings are a critical component in determining an individual's net worth. For Frankie Beverly, as with any professional, the trajectory and magnitude of career income significantly influence their accumulated wealth. This section explores the multifaceted relationship between career income and overall financial standing.

- Performance-Based Income:

Income derived from performances, such as concerts, tours, and other public appearances, is directly tied to career earnings. The frequency and scale of these performances, along with ticket prices and venue size, directly impact the total income accumulated throughout a career. A successful, extensive touring schedule can lead to substantial income generation, impacting the individual's overall net worth.

- Record Sales and Royalties:

Income generated from record sales and associated royalties represents another substantial element of career earnings. The popularity of recordings, combined with licensing agreements and streaming revenue, contributes to a performer's overall income. High sales figures and effective licensing strategies can significantly boost career earnings, impacting a musician's net worth.

- Contractual Agreements and Compensation Structures:

The nature of contractual agreements significantly impacts a career's financial stability. Terms of employment contracts, including salary, performance-based bonuses, and compensation structures, directly affect the musician's income and potential for long-term accumulation. Analysis of contracts provides insight into consistent income streams and their contribution to career earnings.

- Income Fluctuation:

Career income is not always consistent, influenced by factors such as evolving market demand, economic conditions, and shifts in artistic preferences. Understanding these fluctuations is essential for evaluating the impact of career earnings on long-term net worth. Evaluating trends over time can reveal the significance of income consistency and potential for accumulation.

In summary, career earnings play a crucial role in shaping an individual's overall net worth. Examining the various components of career income, including performance-related earnings, record royalties, contract terms, and income variability, provides a more comprehensive understanding of the impact on total wealth. A detailed analysis of Frankie Beverly's career earnings is essential to assess the overall contribution to their net worth.

3. Investment Portfolio

An individual's investment portfolio significantly influences their net worth. Investment choices, diversification strategies, and market performance all play a crucial role. For Frankie Beverly, as for any individual with accumulated wealth, a robust and well-managed investment portfolio is a vital component of their financial standing.

- Asset Allocation and Diversification:

Effective asset allocation distributes investments across various asset classes, such as stocks, bonds, real estate, or alternative investments. Diversification mitigates risk by reducing exposure to the performance of a single asset class. A well-diversified portfolio can enhance long-term returns and stability. Understanding how Frankie Beverly allocated assets and diversified their portfolio provides insight into their risk tolerance and investment strategy, impacting the overall size of their net worth.

- Investment Strategy and Goals:

An investment strategy aligns with specific financial objectives. Short-term goals, such as funding immediate needs, differ from long-term objectives, such as retirement planning. The specific strategy employed and its alignment with personal goals directly influence the overall investment portfolio's return and the potential impact on Frankie Beverly's net worth. Detailed knowledge of the individual's investment strategy provides valuable context regarding the purpose of their investments and expected return profiles.

- Return on Investment (ROI) and Performance:

The performance of investments directly impacts net worth. High-performing investments generate significant returns, increasing the value of the portfolio over time. Understanding historical ROI and market conditions provides valuable insights into the overall growth potential and impact on Frankie Beverly's accumulated wealth. Analyzing investment performance against market benchmarks and industry averages further clarifies the portfolio's effectiveness.

- Potential Impact on Net Worth:

A well-structured investment portfolio, characterized by effective asset allocation, a clear strategy, and demonstrably positive returns, generally leads to a higher net worth. Conversely, poor investment choices or lack of diversification can negatively impact financial stability. Evaluating the portfolio's impact on overall net worth requires examining the portfolio's returns relative to its initial investment value and the overall market trend.

Ultimately, an investment portfolio is a dynamic component of net worth. Its success depends on numerous factors, from asset allocation strategies to market conditions. Understanding how these elements interact and their impact on Frankie Beverly's financial standing clarifies the crucial role of a well-managed portfolio in accumulating and maintaining wealth.

4. Real Estate Holdings

Real estate holdings represent a significant component potentially contributing to an individual's net worth. For Frankie Beverly, as with any individual, the value and nature of real estate holdings directly impact their overall financial standing. This section explores the connection between real estate and Beverly's net worth.

- Property Value and Market Conditions:

The market value of real estate fluctuates based on economic conditions, location, and demand. Increases in property values directly increase net worth, while declining values can decrease it. Understanding the market context in which Beverly's real estate holdings exist is crucial in assessing their impact. Factors such as local market trends, economic indicators, and neighborhood attributes significantly influence property value estimations.

- Types of Real Estate:

Different types of real estateresidential homes, commercial properties, landhave varying values and potential returns. The types of properties Beverly may possesssingle-family homes, apartments, or investment propertieswould influence the nature and magnitude of their impact on net worth. Detailed examination of the types and locations of properties provides insight into the associated financial risks and potential returns.

- Acquisition and Financing Costs:

The original acquisition cost of real estate, along with associated financing costs, such as mortgages, closing costs, and property taxes, significantly affect the calculation of net worth. Understanding the financing structure and historical purchase prices is necessary to establish a comprehensive understanding of the property's impact on Beverly's overall financial picture. Consideration of accumulated interest payments, property taxes, and ongoing maintenance expenses is equally vital.

- Real Estate as an Investment:

Real estate can serve as an investment asset, potentially generating income through rental properties or appreciation in value. If Beverly owns rental properties, the income generated through tenants' rent payments directly influences the overall impact on net worth. The income potential and associated expenses are integral components in assessing the investment value and, consequently, the effect on their net worth.

In conclusion, real estate holdings, given their potential for both appreciating value and generating income, are a crucial factor in calculating net worth. Analyzing the market conditions, property types, acquisition costs, and investment potential associated with Frankie Beverly's real estate provides a more comprehensive understanding of their overall financial standing.

5. Personal Assets

Personal assets, encompassing various tangible and intangible items, contribute significantly to an individual's overall net worth. For Frankie Beverly, as for any individual, these assets represent a diverse collection of possessions potentially influencing their financial standing.

- Vehicles and Transportation:

The value of vehicles, from automobiles to recreational vehicles, can be a substantial component of personal assets. The type, age, and condition of these vehicles, along with their market value, directly impact the overall calculation. High-value or collector's vehicles can significantly increase the total asset value. Appreciation in vehicle values, or conversely, depreciation, are integral factors to consider.

- Collectibles and Art:

Items such as rare books, vintage records, art pieces, or other collectibles can hold significant monetary value. The condition, rarity, and market demand for these items influence their worth. The presence and valuation of such items directly contribute to the estimation of personal assets and their role in overall net worth. Proper documentation and appraisal are essential for accurate valuation.

- Jewelry and Personal Effects:

Valuable jewelry, designer goods, and other personal effects add to the overall asset portfolio. The material, design, brand recognition, and condition of such items greatly influence their market value. These items represent a tangible portion of personal wealth and contribute to the overall calculation of personal assets within the context of net worth. Detailed valuations of these items are necessary to accurately assess their worth.

- Other Possessions:

This category encompasses other valuable possessions, including luxury goods, high-quality electronics, or significant personal property. The value depends on the specific items and their market condition. These items, along with the other categories discussed, collectively contribute to the sum total of personal assets, which in turn plays a part in the overall calculation of net worth.

In conclusion, personal assets are an integral part of an individual's financial picture. Determining the value of these diverse holdings is necessary to provide a comprehensive view of an individual's net worth. The accurate valuation of these diverse categories of assets requires careful consideration of factors such as market trends, condition, and individual value, all crucial for a comprehensive understanding of personal wealth in relation to net worth.

6. Debts and Liabilities

Debts and liabilities directly affect an individual's net worth. They represent financial obligations and represent a deduction from total assets. A significant amount of debt can reduce net worth substantially, and conversely, a low level of debt can enhance it. For instance, an individual with substantial loans or outstanding credit card balances will likely have a lower net worth compared to someone with minimal or no such obligations. Understanding the magnitude and nature of these financial obligations is crucial in assessing an individual's overall financial health and calculating their net worth accurately.

The importance of considering debts and liabilities when evaluating net worth stems from the fundamental accounting principle of asset valuation. Liabilities represent obligations to others, and their inclusion ensures a realistic representation of the individual's financial position. Ignoring debts would inflate the perceived net worth, presenting a misleading picture of the individual's financial situation. For example, a person who claims a high net worth but has substantial outstanding loans, mortgages, or other debts will likely experience financial strain or difficulty in managing their resources.

The accurate assessment of debts and liabilities requires careful consideration of diverse factors. Types of debt, interest rates, and repayment schedules influence the impact on net worth. The calculation of net worth should consider all outstanding financial obligations, including but not limited to mortgages, loans, credit card debt, and other commitments. The impact of these obligations is further amplified or diminished based on the total amount of debt and its relation to the overall assets. Understanding the impact of various debt types, their associated interest rates, and potential penalties is critical to accurately assessing the individual's financial condition. Furthermore, the stability and consistent repayment of these debts contribute to a more accurate evaluation of their financial situation.

In conclusion, debts and liabilities are integral components in calculating net worth. Their inclusion ensures a comprehensive and accurate representation of an individual's financial standing. Ignoring these obligations would produce an unrealistic view, thereby masking potential financial challenges. Thorough documentation and categorization of debts are necessary for a complete understanding of their influence on the overall net worth and financial position. A comprehensive analysis of debts and liabilities within the context of a comprehensive financial evaluation, coupled with proper reporting, leads to a more accurate and realistic assessment of financial standing.

7. Financial Management

Effective financial management is a critical determinant in accumulating and preserving wealth. For any individual, including Frankie Beverly, sound financial practices are essential for maximizing and maintaining a positive net worth. This involves strategic decision-making regarding income, expenses, investments, and debt management, directly influencing the overall financial position. A well-structured financial management strategy directly affects the trajectory of net worth, whether escalating assets or minimizing liabilities.

The effectiveness of financial management hinges on several key aspects. Foremost is meticulous budgeting, allocating resources among essential needs and discretionary spending. This discipline fosters financial stability, preventing overspending and facilitating the accumulation of savings. Furthermore, proactive investment strategies, aligning with financial goals and risk tolerance, are integral to long-term wealth growth. A well-diversified investment portfolio can significantly increase the overall value of assets and contribute to a higher net worth. Conversely, poor financial management, characterized by impulsive spending or avoidance of necessary financial planning, can hinder the growth of assets and potentially lead to increased liabilities, resulting in a decreased net worth. Careful consideration of asset allocation, diversification, and ongoing monitoring of market trends are crucial for achieving favorable returns over time.

Practical application of sound financial management principles can demonstrate the connection to net worth. Consider scenarios where individuals prioritize debt reduction through consistent payments and avoid high-interest debt. This strategic approach reduces financial burdens and frees up resources for investments, ultimately contributing to a higher net worth. In contrast, neglecting debt management often leads to compounding financial obligations, hindering the ability to build wealth. Similarly, individuals who consistently allocate funds towards retirement savings or other long-term goals exhibit sound financial management practices, positioning themselves for a favorable financial future and consequently a higher net worth. Conversely, neglecting long-term financial planning often delays or reduces the ability to accumulate substantial assets, influencing the net worth negatively. Ultimately, the strategies implemented in financial management directly translate into the trajectory of net worth.

In summary, sound financial management plays a pivotal role in achieving and maintaining a favorable net worth. Implementing strategies focused on budgeting, investment management, and debt reduction demonstrates commitment to building and preserving wealth. Effective financial management, characterized by discipline, planning, and ongoing adaptation to evolving financial circumstances, is crucial for increasing and sustaining a positive net worth, regardless of individual circumstances. By understanding and applying these principles, individuals can create a pathway for a sound financial future.

8. Public Perception

Public perception, while not a direct determinant of net worth, significantly influences how an individual's financial standing is perceived and discussed. Public image, often shaped by media portrayals and public commentary, can indirectly affect the estimation or valuation of an individual's wealth. This relationship warrants careful consideration, particularly regarding figures like Frankie Beverly, where public discourse can intersect with financial data and influence perceptions.

- Media Portrayals and Representation:

Media outlets, through their reporting and coverage, play a pivotal role in shaping public opinion. Positive portrayals, highlighting successful ventures or philanthropic activities, often contribute to a more favorable image, potentially boosting perceived wealth. Conversely, negative or controversial narratives might conversely affect this perception. Examples of media impact on public perception of net worth can be observed across various industries and contexts.

- Public Commentary and Speculation:

Social media and online discussions often feature speculation about celebrities' wealth. Online discussions can generate narratives about income streams, investment decisions, or perceived lifestyle choices. These often-unverified assumptions can influence public sentiment regarding an individual's net worth. The absence of concrete data might, however, make it more susceptible to public opinion biases.

- Philanthropic Activities and Public Image:

Philanthropic endeavors significantly impact public perception, particularly regarding artists or celebrities. Engaging in charitable activities can create a positive image, influencing how audiences perceive an individual's wealth and potentially their overall financial situation. This can create a favorable public image that is often indirectly linked to the individual's potential for wealth. Public perception of such actions is highly subjective, and therefore can sometimes affect the calculation of implied wealth.

- Comparison and Contextualization:

Public perception often involves comparison to other celebrities or public figures. This relative assessment shapes public opinion on wealth levels. The social and cultural environment influences these comparisons, potentially leading to misinterpretations of an individual's financial standing based on perceived lifestyle choices or perceived public success. In relation to Frankie Beverly, these comparisons might stem from artistic or professional comparisons that inadvertently influence public perceptions of wealth or financial stability.

In conclusion, public perception, although not a definitive measure of net worth, significantly influences how individuals' financial situations are interpreted. This influence stems from media portrayal, public commentary, philanthropy, and contextual comparison. Considering these elements highlights the indirect yet impactful relationship between public perception and the understanding of wealth, especially in the case of public figures like Frankie Beverly.

Frequently Asked Questions about Frankie Beverly's Net Worth

This section addresses common inquiries regarding Frankie Beverly's financial standing. Information is presented based on publicly available data and general knowledge, acknowledging the inherent limitations of such estimations.

Question 1: What is the precise amount of Frankie Beverly's net worth?

Precise figures for Frankie Beverly's net worth are not publicly available. Estimating an individual's wealth requires comprehensive financial data, including detailed asset valuations, income sources, and liabilities, which are not typically accessible for private individuals.

Question 2: How is net worth calculated?

Net worth is calculated by subtracting an individual's total liabilities from their total assets. Assets encompass possessions of monetary value, while liabilities represent financial obligations. This calculation provides a snapshot of an individual's financial position at a specific time.

Question 3: What are the potential sources of income for a musician like Frankie Beverly?

Income sources for musicians such as Frankie Beverly may include royalties from music recordings, performance fees from concerts and tours, endorsements, and any ventures outside the music industry. Variations in income levels can arise due to factors such as popularity, demand, and performance contracts.

Question 4: Why is precise net worth information often unavailable for public figures?

Maintaining privacy is a common consideration for public figures. Public disclosure of detailed financial information may not align with privacy preferences and legal considerations. Moreover, the complexities of asset valuation and the inherent variability in income streams contribute to the difficulty in accurately ascertaining precise figures.

Question 5: How does public perception impact the perception of an artist's net worth?

Public perception of an artist's wealth is often influenced by media portrayal, public commentary, and perceived success. While not directly correlated with actual net worth, these factors can significantly shape public opinion regarding the individual's financial standing. Factors such as philanthropic activities and lifestyle choices also play a role.

Question 6: What role does effective financial management play in maintaining a positive net worth?

Effective financial management, encompassing sound budgeting, strategic investment decisions, and responsible debt management, is critical in accumulating and preserving wealth. These factors contribute to a higher net worth. Conversely, poor financial practices can lead to financial strain, reducing an individual's net worth.

Understanding the limitations of available data is crucial when considering net worth estimations. This FAQ provides context but does not constitute definitive financial analysis of Frankie Beverly's situation.

Next, we will delve into the details of Frankie Beverly's career, examining the factors that likely contribute to his overall financial standing, within the context of the music industry.

Tips for Financial Success

Achieving and maintaining financial security requires a multifaceted approach. Strategies for effective financial management provide a framework for building and preserving wealth. This section outlines key practices that contribute to overall financial well-being.

Tip 1: Prudent Budgeting and Expense Tracking: Establishing a budget is fundamental. Categorizing income and expenses allows for a clear understanding of financial inflows and outflows. Tracking spending meticulously identifies areas for potential savings and informs decisions regarding financial priorities.

Tip 2: Strategic Investment Planning: Diversifying investments across various asset classes, including stocks, bonds, and real estate, mitigates risk. A well-defined investment strategy aligns with long-term financial goals, maximizing returns and preserving capital. Understanding individual risk tolerance and financial objectives is essential for effective investment decisions.

Tip 3: Prioritizing Debt Reduction: High-interest debt, such as credit card debt, can significantly impact overall financial health. Prioritizing debt reduction through consistent payments, leveraging interest-free periods, or employing debt consolidation strategies, can alleviate financial burdens and free resources for other goals.

Tip 4: Consistent Savings and Emergency Fund Accumulation: Regular savings, even in modest amounts, contribute to long-term financial security. Establishing an emergency fund provides a safety net during unexpected events, preventing reliance on high-interest debt. Consistent savings demonstrate commitment to financial planning and future security.

Tip 5: Seeking Professional Financial Advice: Consultations with financial advisors offer personalized guidance. Experienced professionals can provide tailored strategies aligned with individual circumstances and goals, fostering informed decision-making and potentially accelerating wealth building.

Tip 6: Continuous Learning and Adaptability: The financial landscape evolves, demanding adaptation to current market conditions and regulatory changes. Staying informed through continuous learning and adapting strategies to emerging opportunities helps maintain optimal financial stability.

Tip 7: Avoiding Impulsive Spending and Prioritizing Needs: Distinguishing between wants and needs is crucial. Financial decisions should prioritize essential expenses over discretionary purchases, preventing overspending and promoting long-term financial security.

By integrating these practices, individuals can establish a solid foundation for financial well-being, fostering a secure and prosperous financial future. The consistent application of these tips can lead to a more stable financial position.

In conclusion, consistent financial discipline, strategic planning, and responsible decision-making are key elements in creating lasting financial security. Understanding and implementing these practices empowers individuals to build sustainable wealth.

Conclusion

This article explored the multifaceted factors contributing to Frankie Beverly's financial standing, acknowledging the limitations of publicly available data. Key components examined included income streams, career earnings, investment portfolios, real estate holdings, personal assets, debts and liabilities, sound financial management, and the nuanced influence of public perception. While a precise estimation of net worth remains elusive, the analysis highlights the interconnectedness of these elements in shaping an individual's overall financial picture. The examination underscores the complex interplay of career success, financial choices, market conditions, and the often-unquantifiable influence of public perception.

Ultimately, understanding Frankie Beverly's financial situation, within the confines of available information, offers a glimpse into the realities of wealth accumulation and management, particularly within the context of a career in the performing arts. The complexity of this individual's financial situation, like many others, serves as a reminder of the inherent challenges and considerations involved in evaluating and interpreting such information. Further research, if possible, could offer a more complete picture of Frankie Beverly's financial situation. However, this investigation provides a starting point for a deeper understanding of the factors influencing the financial standing of individuals in this professional field.

Detail Author:

- Name : Prof. Chance Pouros MD

- Username : shanna53

- Email : kovacek.fred@gislason.com

- Birthdate : 1982-05-05

- Address : 14715 Lynch Forks South Donavon, KS 81946-9754

- Phone : +1-276-244-5340

- Company : Rosenbaum LLC

- Job : Purchasing Manager

- Bio : Sit assumenda dignissimos consequatur mollitia labore sint illo. Ratione eum temporibus eum inventore sit.

Socials

twitter:

- url : https://twitter.com/wilkinson1982

- username : wilkinson1982

- bio : Iste alias et quia consequuntur. Voluptas dolorum qui omnis in unde. Labore accusamus sunt sint ex voluptatem quo ut.

- followers : 4248

- following : 430

tiktok:

- url : https://tiktok.com/@araceli_wilkinson

- username : araceli_wilkinson

- bio : Debitis qui aut totam alias voluptatum iusto.

- followers : 6265

- following : 1833

linkedin:

- url : https://linkedin.com/in/araceli.wilkinson

- username : araceli.wilkinson

- bio : Velit fugit id alias recusandae.

- followers : 3779

- following : 254

facebook:

- url : https://facebook.com/araceli9998

- username : araceli9998

- bio : Sit nesciunt ex et at dolor harum qui officia. Amet error inventore qui quia.

- followers : 6201

- following : 1523