Find UBA Swift Code Instantly: A Comprehensive Guide

UBA SWIFT code, also known as the Society for Worldwide Interbank Financial Telecommunication (SWIFT) code, is a unique alphanumeric code that identifies a specific bank branch and facilitates the secure transfer of funds between financial institutions worldwide. It plays a crucial role in international wire transfers and cross-border transactions.

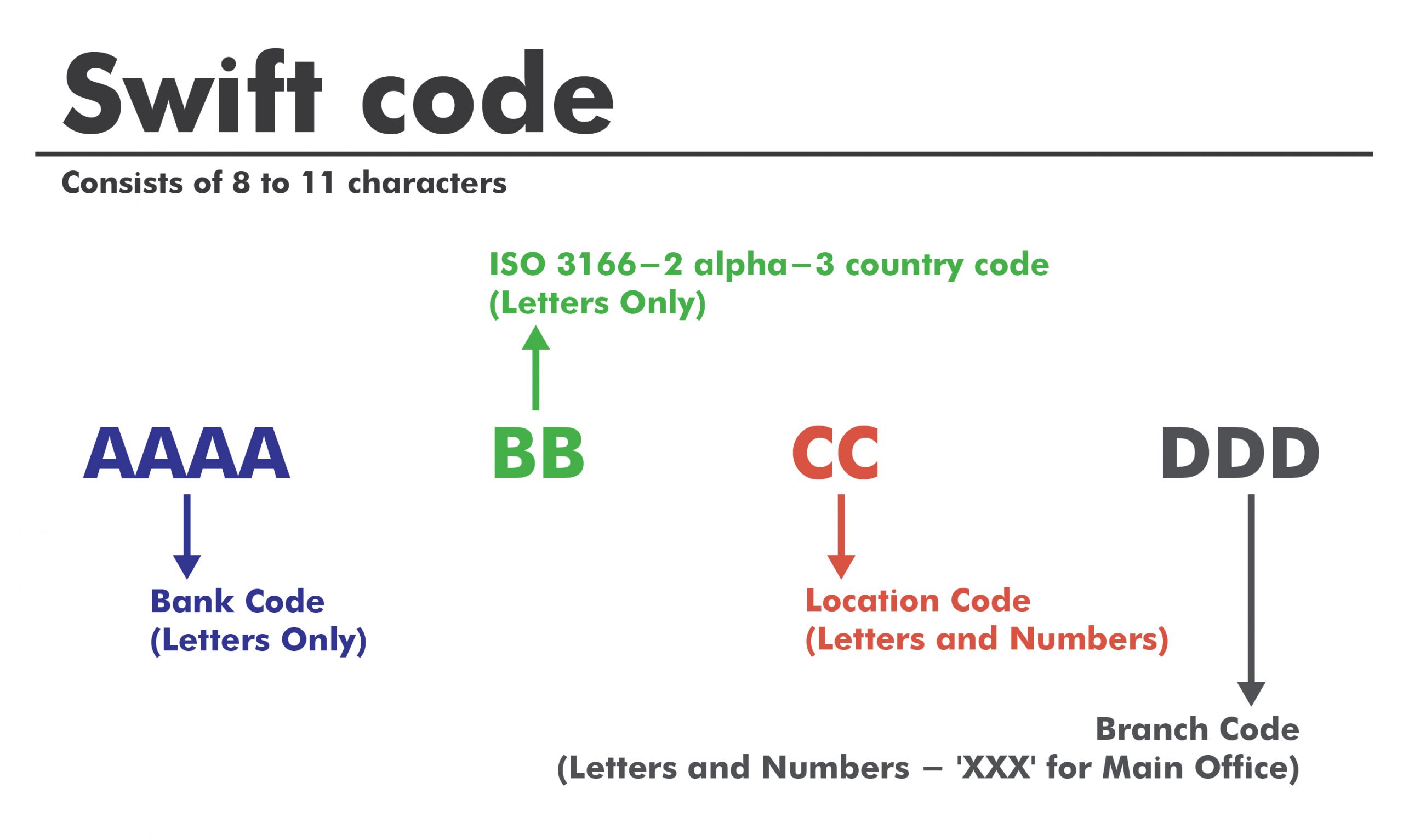

The UBA SWIFT code comprises 8 or 11 characters, each with a specific meaning. The first four characters represent the bank code, the next two represent the country code, the following two represent the location code, and the last three (optional) characters represent the branch code. For instance, the UBA SWIFT code for its head office in Lagos, Nigeria, is UNAGBICALAG.

Providing the correct UBA SWIFT code is essential for ensuring that international wire transfers are routed to the intended recipient's bank account promptly and securely. Errors in the SWIFT code can lead to delays, additional fees, or even failed transactions. Hence, it is crucial to obtain the correct SWIFT code directly from the bank or through reliable sources.

- Profiling The Talented Ullu Web Series Actress Name

- Bold Move An Indepth Look At Lyra Crows Life Career And Controversies

In summary, the UBA SWIFT code is a vital tool in facilitating international money transfers and cross-border transactions. By utilizing the correct SWIFT code, individuals and businesses can ensure the smooth and secure movement of funds worldwide.

UBA SWIFT Code

The UBA SWIFT code plays a pivotal role in international money transfers and cross-border transactions. Here are eight key aspects to consider:

- Unique identifier: Each UBA branch has a unique SWIFT code, ensuring secure and accurate fund transfers.

- International standard: SWIFT codes adhere to international standards, facilitating seamless communication between banks worldwide.

- Secure transactions: SWIFT codes enhance the security of international wire transfers, reducing the risk of fraud and errors.

- Swift processing: SWIFT codes enable faster processing of international transactions, ensuring timely delivery of funds.

- Global reach: UBA's SWIFT code network spans across the globe, enabling convenient and efficient cross-border payments.

- Easy identification: The structured format of SWIFT codes makes it easy to identify the specific bank branch involved in a transaction.

- Essential for international transfers: Providing the correct UBA SWIFT code is crucial for successful international wire transfers.

- Verify with the bank: Always verify the SWIFT code with the bank or through reliable sources to ensure accuracy.

These key aspects highlight the significance of the UBA SWIFT code in facilitating global financial transactions. By understanding these aspects, individuals and businesses can ensure the smooth and secure transfer of funds across borders.

- Mastering The Secret Salt Trick For Men Enhance Your Life Like A Pro

- Telugu Movies Download Movierulz Alternatives And More Your Ultimate Guide

1. Unique identifier

The unique SWIFT code assigned to each UBA branch serves as a critical component of the UBA SWIFT code system. This unique identifier plays a pivotal role in ensuring the secure and accurate transfer of funds across borders.

When an international wire transfer is initiated, the sender's bank utilizes the recipient's UBA SWIFT code to identify the specific branch where the funds should be deposited. The SWIFT code acts as a secure and standardized method of communication between banks, facilitating the seamless routing of funds to the intended destination.

The uniqueness of each UBA branch's SWIFT code is crucial for ensuring that funds are transferred accurately and efficiently. Without a unique identifier, there would be a higher risk of funds being misrouted or delayed, potentially leading to financial losses or inconvenience for the sender and recipient.

In summary, the unique identifier aspect of the UBA SWIFT code is a fundamental element that contributes to the secure and accurate transfer of funds across borders. It ensures that each UBA branch has a distinct identity within the global financial network, enabling efficient and reliable international transactions.

2. International standard

The adherence of UBA SWIFT codes to international standards is a crucial aspect that enables seamless communication between banks worldwide. SWIFT (Society for Worldwide Interbank Financial Telecommunication) is a global messaging network that facilitates secure and standardized communication among financial institutions.

By adhering to these international standards, UBA SWIFT codes ensure that:

- Universal recognition: UBA SWIFT codes are recognized by banks worldwide, enabling the smooth and efficient processing of international wire transfers.

- Secure transactions: SWIFT's standardized messaging system enhances the security of international transactions, reducing the risk of fraud and errors.

- Interoperability: The international standards governing SWIFT codes ensure that UBA SWIFT codes can be seamlessly used with SWIFT codes from other banks, facilitating cross-border transactions.

The international standardization of UBA SWIFT codes is essential for the efficient and reliable transfer of funds across borders. Without this standardization, international wire transfers would be more complex, time-consuming, and prone to errors.

In summary, the international standard of UBA SWIFT codes is a critical component that underpins the seamless communication between banks worldwide. This standardization ensures secure, efficient, and interoperable cross-border transactions, contributing to the smooth flow of global commerce and finance.

3. Secure transactions

The secure nature of UBA SWIFT codes is a significant component contributing to the overall security of international wire transfers. SWIFT (Society for Worldwide Interbank Financial Telecommunication) has established robust security measures to protect against fraud and errors in international financial transactions.

UBA SWIFT codes play a crucial role in this security framework by providing a secure and standardized method of communication between banks. The SWIFT network utilizes advanced encryption techniques and authentication protocols to ensure that messages containing sensitive financial information are protected from unauthorized access and interception.

Moreover, the unique identifier aspect of UBA SWIFT codes helps prevent fraud by ensuring that funds are transferred only to the intended recipient's bank account. Each UBA branch has a unique SWIFT code, eliminating the possibility of funds being misdirected to fraudulent accounts.

In summary, the secure nature of UBA SWIFT codes is a critical element of the international wire transfer process. By adhering to international security standards and implementing robust security measures, UBA SWIFT codes help protect against fraud and errors, ensuring the safe and reliable transfer of funds across borders.

4. Swift processing

The swift processing facilitated by SWIFT codes is an integral component of the UBA SWIFT code system, contributing to the timely delivery of funds in international transactions.

When an international wire transfer is initiated, the sender's bank utilizes the recipient's UBA SWIFT code to identify the specific branch where the funds should be deposited. The SWIFT code acts as a secure and standardized method of communication between banks, enabling the swift and efficient routing of funds to the intended destination.

The swift processing of international transactions offered by UBA SWIFT codes provides several advantages:

- Reduced transaction times: SWIFT codes enable faster processing of international wire transfers, reducing the time it takes for funds to reach the recipient's account.

- Improved efficiency: The streamlined and efficient processing of international transactions through UBA SWIFT codes enhances the overall efficiency of cross-border payments.

- Enhanced customer satisfaction: Swift processing of international transactions contributes to improved customer satisfaction by ensuring that funds are delivered promptly and as expected.

In summary, the swift processing of international transactions facilitated by UBA SWIFT codes is a critical aspect of the international wire transfer process. By enabling faster and more efficient cross-border payments, UBA SWIFT codes contribute to the smooth flow of global commerce and finance.

5. Global reach

The global reach of UBA's SWIFT code network is a significant component that contributes to the overall effectiveness and convenience of UBA SWIFT codes. With a presence in over 20 countries across Africa, Europe, the Americas, and Asia, UBA's SWIFT code network facilitates seamless cross-border payments worldwide.

The extensive reach of UBA's SWIFT code network offers several advantages:

- Convenient cross-border payments: UBA's global SWIFT code network makes it easy and convenient to send and receive international wire transfers, eliminating geographical barriers and simplifying the process.

- Efficient cross-border payments: The streamlined and efficient processing of international transactions through UBA's SWIFT code network reduces transaction times and ensures the timely delivery of funds.

- Enhanced global connectivity: UBA's SWIFT code network connects businesses and individuals to a vast network of banks and financial institutions worldwide, fostering global commerce and financial inclusion.

6. Easy identification

The easy identification facilitated by the structured format of SWIFT codes plays a crucial role in the effective utilization of UBA SWIFT codes for international wire transfers.

- Standardized format: SWIFT codes adhere to a standardized format, consisting of 8 or 11 characters arranged in a specific order. This standardized format ensures that each character within the SWIFT code conveys specific information, such as the bank code, country code, location code, and branch code.

- Quick identification: The structured format of SWIFT codes allows for quick and easy identification of the specific bank branch involved in a transaction. By simply examining the SWIFT code, banks and financial institutions can readily determine the exact branch where the funds should be directed, reducing the risk of errors and delays.

- Reduced errors: The easy identification provided by the structured format of SWIFT codes helps minimize errors in international wire transfers. By providing a clear and concise way to identify the recipient bank branch, the structured format reduces the likelihood of funds being misdirected or delayed due to incorrect SWIFT codes.

In summary, the easy identification facilitated by the structured format of SWIFT codes is a key aspect of UBA SWIFT codes. It enables banks and financial institutions to quickly and accurately identify the specific bank branch involved in a transaction, thereby ensuring the smooth and efficient transfer of funds across borders.

7. Essential for international transfers

The correct UBA SWIFT code is an essential component for successful international wire transfers. It acts as a unique identifier for the specific bank branch where the funds should be sent, ensuring that the transfer is routed correctly and reaches the intended recipient.

Without the correct UBA SWIFT code, international wire transfers may encounter delays, errors, or even fail to be completed. This is because the SWIFT code is used by banks to identify the beneficiary bank and account, and an incorrect code could result in the funds being sent to the wrong account or even lost.

Therefore, it is crucial to obtain the correct UBA SWIFT code directly from the recipient's bank or through reliable sources. By providing the correct SWIFT code, individuals and businesses can ensure that their international wire transfers are processedand securely, avoiding potential delays or complications.

8. Verify with the bank

Verifying the UBA SWIFT code with the bank or through reliable sources is of paramount importance for the successful completion of international wire transfers. As discussed earlier, the SWIFT code serves as a unique identifier for a specific bank branch, and an incorrect code can lead to delays, errors, or even failed transactions.

Therefore, it is crucial to obtain the correct UBA SWIFT code directly from the recipient's bank. This can be done by contacting the bank via phone, email, or visiting their website. Alternatively, individuals and businesses can use reliable online resources that provide up-to-date and accurate SWIFT codes. These resources may include financial websites or specialized SWIFT code lookup tools.

By verifying the UBA SWIFT code with the bank or through reliable sources, individuals and businesses can ensure that their international wire transfers are processed securely and efficiently. This helps to avoid potential delays or complications, ensuring that funds reach the intended recipient promptly and accurately.

UBA SWIFT Code FAQs

This section addresses frequently asked questions (FAQs) regarding UBA SWIFT codes, providing clear and informative answers to common concerns and misconceptions.

Question 1: What is a UBA SWIFT code?

A UBA SWIFT code is a unique alphanumeric code that identifies a specific branch of United Bank for Africa (UBA). It is used to facilitate secure and efficient international wire transfers.

Question 2: Why is it important to use the correct UBA SWIFT code?

Providing the correct UBA SWIFT code is crucial for ensuring that international wire transfers are routed to the intended recipient's bank account promptly and securely. Errors in the SWIFT code can lead to delays, additional fees, or even failed transactions.

Question 3: How can I find the UBA SWIFT code for a specific branch?

The best way to obtain the correct UBA SWIFT code is to contact the bank directly or visit their website. You can also use reliable online resources that provide up-to-date and accurate SWIFT codes.

Question 4: Are UBA SWIFT codes the same for all transactions?

No, UBA SWIFT codes are unique to each branch of the bank. It is important to ensure that you have the correct SWIFT code for the specific branch where you need to send funds.

Question 5: Can I use a UBA SWIFT code to send money to a non-UBA account?

UBA SWIFT codes are primarily used for international wire transfers within the UBA network. If you need to send money to a non-UBA account, you may need to use a different method, such as an international money transfer service or a correspondent bank.

Question 6: Are UBA SWIFT codes secure?

Yes, UBA SWIFT codes are secure. They adhere to international standards and utilize robust security measures to protect against fraud and unauthorized access.

These FAQs provide a comprehensive overview of common questions and concerns related to UBA SWIFT codes. By understanding these aspects, individuals and businesses can ensure the smooth and secure transfer of funds across borders.

To learn more about UBA SWIFT codes or international wire transfers, please consult the relevant resources provided by UBA or other reputable sources.

UBA SWIFT Code Tips

To ensure seamless and secure international wire transfers using UBA SWIFT codes, consider the following tips:

Tip 1: Obtain the correct SWIFT code: Contact the recipient's bank directly or utilize reliable online resources to obtain the accurate and up-to-date UBA SWIFT code for the specific branch where the funds should be sent.

Tip 2: Verify the SWIFT code: Double-check the UBA SWIFT code carefully before initiating the wire transfer. Ensure that all characters are correct and match the information provided by the recipient's bank.

Tip 3: Use the correct format: UBA SWIFT codes follow a standardized format. Ensure that the code you provide consists of 8 or 11 characters, arranged in the correct order.

Tip 4: Avoid intermediaries: When possible, send international wire transfers directly to the recipient's bank account using the UBA SWIFT code. This helps to reduce the risk of delays or errors that may occur when using intermediary banks.

Tip 5: Be aware of fees: International wire transfers may incur fees. Contact your bank or the recipient's bank to inquire about any applicable fees before initiating the transfer.

Tip 6: Track the transfer: Once you have initiated the wire transfer, track its status regularly. You can do this by contacting your bank or using online tracking tools provided by the bank.

Tip 7: Keep a record: Maintain a record of all international wire transfers, including the UBA SWIFT code used. This can be useful for future reference or if any issues arise.

By following these tips, individuals and businesses can increase the efficiency, security, and accuracy of their international wire transfers using UBA SWIFT codes.

Remember, UBA SWIFT codes are essential for facilitating secure and smooth cross-border payments. By utilizing these codes correctly, you can ensure the timely and reliable transfer of funds worldwide.

Conclusion

In conclusion, the UBA SWIFT code plays a critical role in facilitating secure, efficient, and reliable international wire transfers. By utilizing the correct UBA SWIFT code, individuals and businesses can ensure that their funds are transferred accurately and promptly to the intended recipient's bank account.

The key aspects of UBA SWIFT codes discussed in this article, including their unique identifier, international standard, secure transactions, swift processing, global reach, easy identification, and essential nature for international transfers, all contribute to the effectiveness of this system. By understanding these aspects and adhering to the tips provided, individuals and businesses can optimize their use of UBA SWIFT codes for seamless and secure cross-border payments.

As the world continues to become increasingly interconnected, the significance of UBA SWIFT codes will only grow. By embracing the use of UBA SWIFT codes and leveraging its benefits, individuals and businesses can actively participate in the global economy and contribute to the smooth flow of international trade and finance.

Detail Author:

- Name : Bertrand Leffler

- Username : khand

- Email : brekke.mariano@yahoo.com

- Birthdate : 2001-02-16

- Address : 9250 Conn Mountain Suite 738 East Demond, NV 39807-3483

- Phone : 1-239-632-6696

- Company : Wolf, Keeling and Conroy

- Job : Head Nurse

- Bio : Minus error in quos est quis. Eum iure sed praesentium dolor. Non natus sint distinctio neque ea et libero. Nesciunt in voluptatem numquam nemo.

Socials

facebook:

- url : https://facebook.com/elvie_reinger

- username : elvie_reinger

- bio : Repudiandae soluta ratione illo qui.

- followers : 891

- following : 2249

linkedin:

- url : https://linkedin.com/in/ereinger

- username : ereinger

- bio : Aut et nam sit voluptatibus sapiente aliquid.

- followers : 1818

- following : 2426

tiktok:

- url : https://tiktok.com/@elvie_id

- username : elvie_id

- bio : Et dolorem maiores debitis eos minus. Totam officia velit incidunt impedit.

- followers : 3165

- following : 2992