Tiger Global 13F: The Latest Portfolio Disclosures And Insights

Tiger Global 13F is a quarterly report that details the investment portfolio of Tiger Global Management, a New York-based investment firm. The report is filed with the Securities and Exchange Commission (SEC) and provides insights into the firm's investment strategy and the performance of its portfolio.

Tiger Global is known for its focus on growth investing, and its portfolio often includes a mix of technology, consumer, and healthcare companies. The firm has a history of investing in successful startups, including Facebook, Spotify, and Airbnb. Tiger Global 13F is closely watched by investors and analysts as it provides a glimpse into the firm's investment thinking and can serve as a valuable resource for making investment decisions.

Some of the key topics covered in Tiger Global 13F include the firm's top holdings, its sector allocation, and its recent investment activity. The report can also provide insights into the performance of the firm's portfolio relative to benchmarks and peers.

- Banana Nomads A Comprehensive Look At The Global Phenomenon

- Best Vegan Movies A Cinematic Feast For Plantbased Lovers

Tiger Global 13F

Tiger Global 13F is a quarterly report filed with the Securities and Exchange Commission (SEC) that details the investment portfolio of Tiger Global Management, a New York-based investment firm. The report provides insights into the firm's investment strategy, portfolio performance, and top holdings.

- Growth investing: Tiger Global is known for its focus on growth investing, and its portfolio often includes a mix of technology, consumer, and healthcare companies.

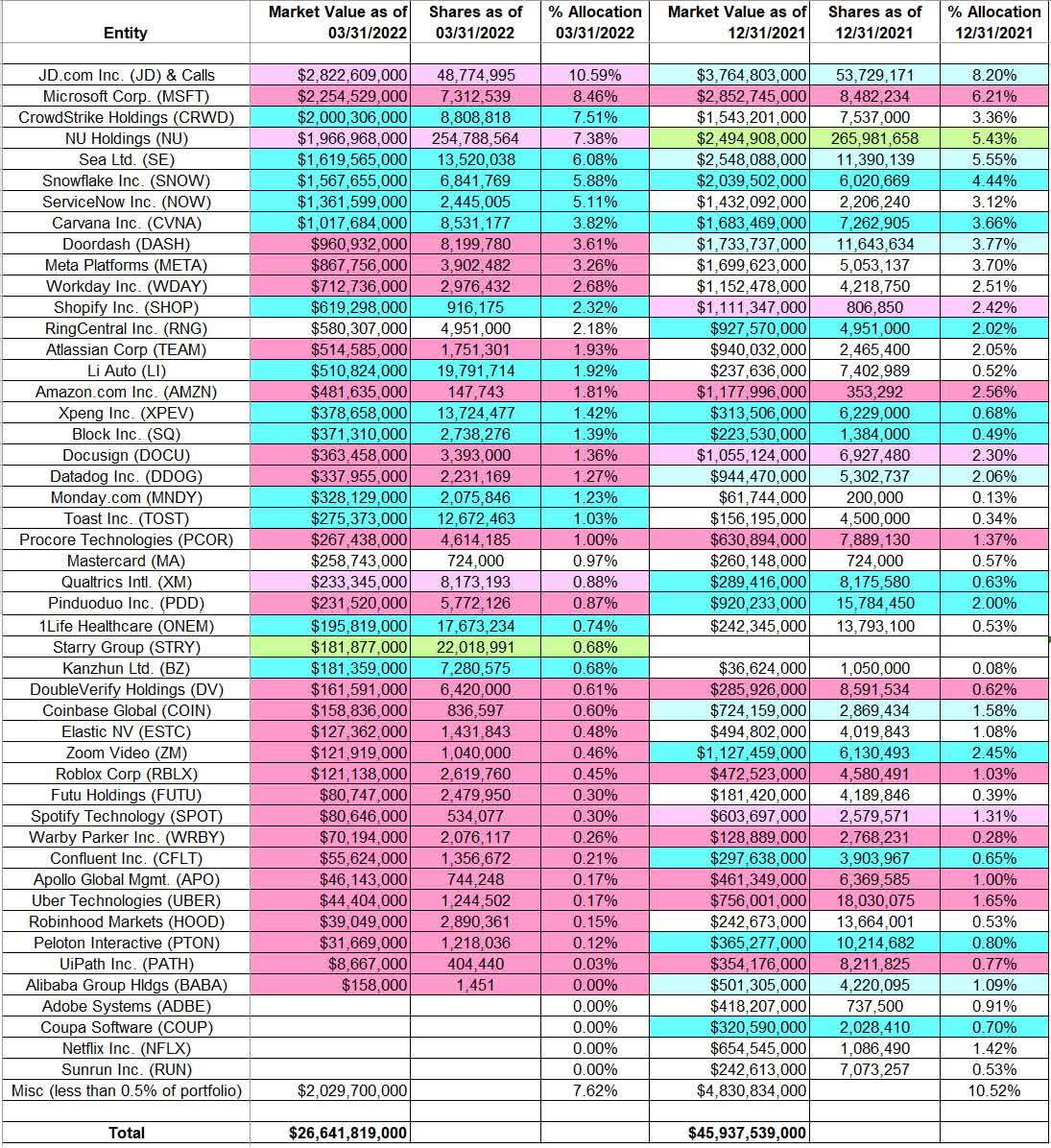

- Top holdings: The report details the firm's top holdings, which can provide insights into the firm's investment strategy and the performance of its portfolio.

- Sector allocation: The report provides a breakdown of the firm's portfolio by sector, which can provide insights into the firm's risk appetite and investment strategy.

- Recent investment activity: The report details the firm's recent investment activity, which can provide insights into the firm's investment strategy and the performance of its portfolio.

- Performance: The report provides insights into the performance of the firm's portfolio relative to benchmarks and peers.

- Investment strategy: The report can provide insights into the firm's investment strategy, including its investment philosophy, risk management practices, and portfolio construction.

- Investment philosophy: The report can provide insights into the firm's investment philosophy, including its focus on growth investing, its investment horizon, and its risk tolerance.

Tiger Global 13F is a valuable resource for investors and analysts as it provides a glimpse into the firm's investment thinking and can serve as a valuable resource for making investment decisions.

1. Growth investing

Tiger Global's focus on growth investing is a key aspect of its investment strategy and is reflected in the composition of its portfolio. The firm seeks out companies with high growth potential, typically in the technology, consumer, and healthcare sectors. These companies are often early-stage or emerging growth companies that have the potential to generate significant returns over the long term.

- Latest Adult Movies 18 Releases On Movierulz What You Need To Know

- New Sone 385 Features And Benefits Revolutionizing The Way You Live

- High growth potential

Tiger Global looks for companies with high growth potential, as measured by factors such as revenue growth, market share, and competitive advantage. The firm believes that these companies have the potential to generate significant returns over the long term.

- Technology, consumer, and healthcare sectors

Tiger Global primarily invests in companies in the technology, consumer, and healthcare sectors. The firm believes that these sectors are poised for continued growth and offer attractive investment opportunities.

- Early-stage and emerging growth companies

Tiger Global often invests in early-stage and emerging growth companies. These companies are typically smaller and have less established track records than more mature companies. However, Tiger Global believes that these companies have the potential to generate significant returns over the long term.

- Long-term investment horizon

Tiger Global has a long-term investment horizon. The firm is willing to hold investments for multiple years, or even decades, in order to capture the full potential of its investments.

Tiger Global's focus on growth investing has been a key driver of its success. The firm has generated strong returns for its investors over the long term.

2. Top holdings

The top holdings of Tiger Global Management, as reported in its 13F filings, provide valuable insights into the firm's investment strategy and the performance of its portfolio. By analyzing the firm's top holdings, investors can gain insights into the following:

- Investment strategy: The firm's top holdings can provide insights into the firm's investment strategy, including its sector allocation, investment style, and risk tolerance.

- Portfolio performance: The performance of the firm's top holdings can provide insights into the overall performance of the firm's portfolio.

For example, if Tiger Global Management has a large allocation to technology stocks in its top holdings, this may indicate that the firm is bullish on the technology sector and believes that technology stocks have the potential to generate strong returns. Similarly, if the firm's top holdings have been performing well, this may indicate that the firm's overall portfolio is also performing well.

Overall, the top holdings of Tiger Global Management, as reported in its 13F filings, are a valuable resource for investors seeking to understand the firm's investment strategy and the performance of its portfolio.

3. Sector allocation

The sector allocation of Tiger Global Management, as reported in its 13F filings, provides valuable insights into the firm's risk appetite and investment strategy. By analyzing the firm's sector allocation, investors can gain insights into the following:

- Risk appetite: The firm's sector allocation can provide insights into the firm's risk appetite. For example, a firm with a large allocation to cyclical sectors, such as technology and consumer discretionary, may be considered to have a higher risk appetite than a firm with a large allocation to defensive sectors, such as utilities and consumer staples.

- Investment strategy: The firm's sector allocation can provide insights into the firm's investment strategy. For example, a firm with a large allocation to growth sectors, such as technology and healthcare, may be considered to have a growth investment strategy, while a firm with a large allocation to value sectors, such as financials and energy, may be considered to have a value investment strategy.

For example, if Tiger Global Management has a large allocation to technology stocks in its portfolio, this may indicate that the firm has a high risk appetite and believes that technology stocks have the potential to generate strong returns. Similarly, if the firm has a large allocation to defensive sectors, such as utilities and consumer staples, this may indicate that the firm has a lower risk appetite and is seeking to preserve capital.

Overall, the sector allocation of Tiger Global Management, as reported in its 13F filings, is a valuable resource for investors seeking to understand the firm's risk appetite and investment strategy.

4. Recent investment activity

The recent investment activity of Tiger Global Management, as reported in its 13F filings, provides valuable insights into the firm's investment strategy and the performance of its portfolio. By analyzing the firm's recent investment activity, investors can gain insights into the following:

- Investment strategy: The firm's recent investment activity can provide insights into the firm's investment strategy, including its sector allocation, investment style, and risk tolerance.

- Portfolio performance: The performance of the firm's recent investments can provide insights into the overall performance of the firm's portfolio.

For example, if Tiger Global Management has recently made a large investment in a particular sector, such as technology or healthcare, this may indicate that the firm is bullish on that sector and believes that it has the potential to generate strong returns. Similarly, if the firm has recently sold a large stake in a particular stock, this may indicate that the firm is bearish on that stock or that it is seeking to reduce its risk exposure.

Overall, the recent investment activity of Tiger Global Management, as reported in its 13F filings, is a valuable resource for investors seeking to understand the firm's investment strategy and the performance of its portfolio.

Example

In recent years, Tiger Global Management has been actively investing in technology startups, particularly in the areas of artificial intelligence, cloud computing, and fintech. This indicates that the firm is bullish on the technology sector and believes that these areas have the potential to generate strong returns. Some of the firm's recent investments in technology startups include Airbnb, Spotify, and Stripe.

Conclusion

The recent investment activity of Tiger Global Management, as reported in its 13F filings, provides valuable insights into the firm's investment strategy and the performance of its portfolio. By analyzing the firm's recent investment activity, investors can gain insights into the firm's sector allocation, investment style, risk tolerance, and overall portfolio performance.

5. Performance

The performance of a fund is a critical factor for investors to consider when making investment decisions. Tiger Global 13F provides insights into the performance of Tiger Global Management's portfolio relative to benchmarks and peers, which can be valuable for investors in several ways:

- Benchmarking: By comparing the performance of Tiger Global Management's portfolio to relevant benchmarks, such as the S&P 500 or the Nasdaq Composite, investors can assess how well the fund has performed relative to the broader market.

- Peer comparison: By comparing the performance of Tiger Global Management's portfolio to that of similar funds, investors can assess how well the fund has performed relative to its peers.

- Investment decision-making: The performance of a fund relative to benchmarks and peers can be a key factor in investment decision-making. Investors may choose to invest in funds that have consistently outperformed their benchmarks and peers, as this may indicate that the fund has a skilled investment team and a strong investment strategy.

For example, if Tiger Global Management's portfolio has consistently outperformed the S&P 500 over a period of several years, this may indicate that the fund has a strong investment team and a successful investment strategy. This information can be valuable for investors who are considering investing in Tiger Global Management's fund.

Overall, the performance of a fund relative to benchmarks and peers is a key factor for investors to consider when making investment decisions. Tiger Global 13F provides insights into the performance of Tiger Global Management's portfolio relative to benchmarks and peers, which can be valuable for investors in several ways.

6. Investment strategy

Tiger Global 13F provides insights into the investment strategy of Tiger Global Management, a New York-based investment firm. The report details the firm's portfolio holdings, sector allocation, and recent investment activity, which can provide valuable information about the firm's investment philosophy, risk management practices, and portfolio construction.

The investment strategy of a firm is a key factor in determining its performance. Tiger Global Management's investment strategy is focused on growth investing, and the firm typically invests in companies with high growth potential in the technology, consumer, and healthcare sectors. The firm has a long-term investment horizon and is willing to hold investments for multiple years, or even decades, in order to capture the full potential of its investments.

Tiger Global Management's risk management practices are designed to mitigate the risk of losses. The firm uses a variety of risk management techniques, including diversification, hedging, and stress testing. The firm also has a dedicated risk management team that monitors the firm's portfolio and identifies potential risks.

Tiger Global Management's portfolio construction is designed to achieve the firm's investment objectives. The firm's portfolio is typically diversified across a range of asset classes, including stocks, bonds, and private equity. The firm also uses a variety of investment strategies, including long-only, short-selling, and merger arbitrage.

Tiger Global 13F provides valuable insights into the investment strategy of Tiger Global Management. The report can be used by investors to make informed investment decisions.

7. Investment philosophy

Tiger Global 13F provides insights into the investment philosophy of Tiger Global Management, a New York-based investment firm. The report details the firm's portfolio holdings, sector allocation, and recent investment activity, which can provide valuable information about the firm's investment philosophy, risk management practices, and portfolio construction.

- Focus on growth investing

Tiger Global Management is a growth investor, meaning that it seeks out companies with high growth potential. The firm typically invests in companies in the technology, consumer, and healthcare sectors, which are known for their high growth potential. Tiger Global Management's focus on growth investing is reflected in its portfolio holdings, which include many high-growth companies, such as Airbnb, Spotify, and Stripe.

- Long-term investment horizon

Tiger Global Management has a long-term investment horizon, meaning that it is willing to hold investments for multiple years, or even decades, in order to capture the full potential of its investments. The firm's long-term investment horizon is reflected in its portfolio holdings, which include many companies that are still in their early stages of growth. Tiger Global Management is willing to be patient with its investments and wait for them to mature.

- Moderate risk tolerance

Tiger Global Management has a moderate risk tolerance, meaning that it is willing to take on some risk in order to achieve its investment objectives. The firm's moderate risk tolerance is reflected in its portfolio holdings, which include a mix of high-growth companies and more established companies. Tiger Global Management is willing to take on some risk, but it is not willing to take on excessive risk.

Tiger Global Management's investment philosophy is a key factor in its success. The firm's focus on growth investing, its long-term investment horizon, and its moderate risk tolerance have helped it to generate strong returns for its investors over the long term.

Tiger Global 13F FAQs

Tiger Global 13F is a quarterly report that details the investment portfolio of Tiger Global Management, a New York-based investment firm. The report is filed with the Securities and Exchange Commission (SEC) and provides insights into the firm's investment strategy and the performance of its portfolio.

Here are six frequently asked questions about Tiger Global 13F:

Question 1: What is Tiger Global 13F?

Tiger Global 13F is a quarterly report that details the investment portfolio of Tiger Global Management. The report is filed with the SEC and provides insights into the firm's investment strategy and the performance of its portfolio.

Question 2: What can I learn from Tiger Global 13F?

Tiger Global 13F can provide insights into the firm's investment strategy, portfolio performance, and top holdings. The report can also be used to track the firm's recent investment activity.

Question 3: How can I access Tiger Global 13F?

Tiger Global 13F is available on the SEC's website. The report is filed quarterly and is typically available within 45 days of the end of the quarter.

Question 4: Is Tiger Global 13F a good investment?

Tiger Global 13F is not an investment. The report is a source of information about Tiger Global Management's investment portfolio. Investors should conduct their own research before making any investment decisions.

Question 5: How often is Tiger Global 13F updated?

Tiger Global 13F is updated quarterly. The report is typically available within 45 days of the end of the quarter.

Question 6: Where can I find more information about Tiger Global 13F?

More information about Tiger Global 13F is available on the SEC's website. Investors can also contact Tiger Global Management directly for more information.

Summary

Tiger Global 13F is a valuable resource for investors and analysts. The report provides insights into the firm's investment strategy, portfolio performance, and top holdings. Investors can use the report to make informed investment decisions.

Transition to the next article section

The next section of this article will discuss the investment strategy of Tiger Global Management.

Tips for Using Tiger Global 13F

Tiger Global 13F provides valuable insights into the investment strategy of Tiger Global Management, a New York-based investment firm. The report can be used by investors to make informed investment decisions.

Tip 1: Track the firm's investment strategy

Tiger Global 13F can be used to track the firm's investment strategy over time. The report provides insights into the firm's sector allocation, top holdings, and recent investment activity. This information can be used by investors to make informed investment decisions.

Tip 2: Identify potential investment opportunities

Tiger Global 13F can be used to identify potential investment opportunities. The report provides insights into the firm's investment strategy and top holdings. This information can be used by investors to identify companies that are well-positioned for growth.

Tip 3: Manage risk

Tiger Global 13F can be used to manage risk. The report provides insights into the firm's risk management practices. This information can be used by investors to make informed investment decisions.

Tip 4: Compare the firm to its peers

Tiger Global 13F can be used to compare the firm to its peers. The report provides insights into the firm's performance relative to benchmarks and peers. This information can be used by investors to make informed investment decisions.

Tip 5: Stay up-to-date on the latest developments

Tiger Global 13F is updated quarterly. The report provides insights into the firm's latest investment activity. This information can be used by investors to stay up-to-date on the latest developments.

Summary

Tiger Global 13F is a valuable resource for investors. The report provides insights into the firm's investment strategy, portfolio performance, and top holdings. Investors can use the report to make informed investment decisions.

Transition to the article's conclusion

The next section of this article will discuss the investment strategy of Tiger Global Management.

Conclusion

Tiger Global 13F is a valuable resource for investors and analysts. The report provides insights into the investment strategy of Tiger Global Management, a New York-based investment firm. The report can be used by investors to make informed investment decisions.

Tiger Global 13F provides insights into the firm's sector allocation, top holdings, and recent investment activity. This information can be used by investors to track the firm's investment strategy over time and identify potential investment opportunities. The report also provides insights into the firm's risk management practices and performance relative to benchmarks and peers. This information can be used by investors to manage risk and make informed investment decisions.

Tiger Global 13F is a valuable resource for investors and analysts. The report can be used to make informed investment decisions, manage risk, and stay up-to-date on the latest developments in the investment industry.

Detail Author:

- Name : Alycia Reilly

- Username : kerluke.ludwig

- Email : grimes.mandy@yahoo.com

- Birthdate : 1970-11-30

- Address : 864 Aiyana Harbors Lake Abrahamborough, KS 51922-4493

- Phone : +1 (949) 538-1469

- Company : McKenzie-Lebsack

- Job : Electrician

- Bio : Corporis nulla qui quia illo illo et. Enim adipisci ipsa sed molestiae quidem eum. Ipsa omnis nihil officiis possimus ea assumenda aperiam.

Socials

tiktok:

- url : https://tiktok.com/@wolf2004

- username : wolf2004

- bio : Soluta et est porro magni animi nihil. Ea sed sapiente eveniet at.

- followers : 5700

- following : 2664

linkedin:

- url : https://linkedin.com/in/wolfu

- username : wolfu

- bio : Laborum perspiciatis quas ullam error.

- followers : 316

- following : 2651

instagram:

- url : https://instagram.com/wolfu

- username : wolfu

- bio : Illum adipisci id ut enim quas rem magni amet. Nesciunt a qui incidunt porro eos libero assumenda.

- followers : 4895

- following : 2370